Apple TV+'s Library Is 4K% Smaller Than Netflix. That Hasn't Impacted Revenue. Yet.

Apple TV+’s major price hike in Q4 2023 has driven the most significant jump in average revenue per user (ARPU) and revenue, despite leading to an immediate uptick in churn. Apple saw a notable increase in revenue in the quarter in which these changes were implemented. Specifically, a 33% increase in quarterly UCAN revenue in Q4 2023 after its price hike, according to Parrot Analytics. While the 43% price increase for Apple TV+ led to increased churn, it helped the platform better monetize itssubscribers like a traditional SVOD business model and resulted in a substantial jump in revenue.

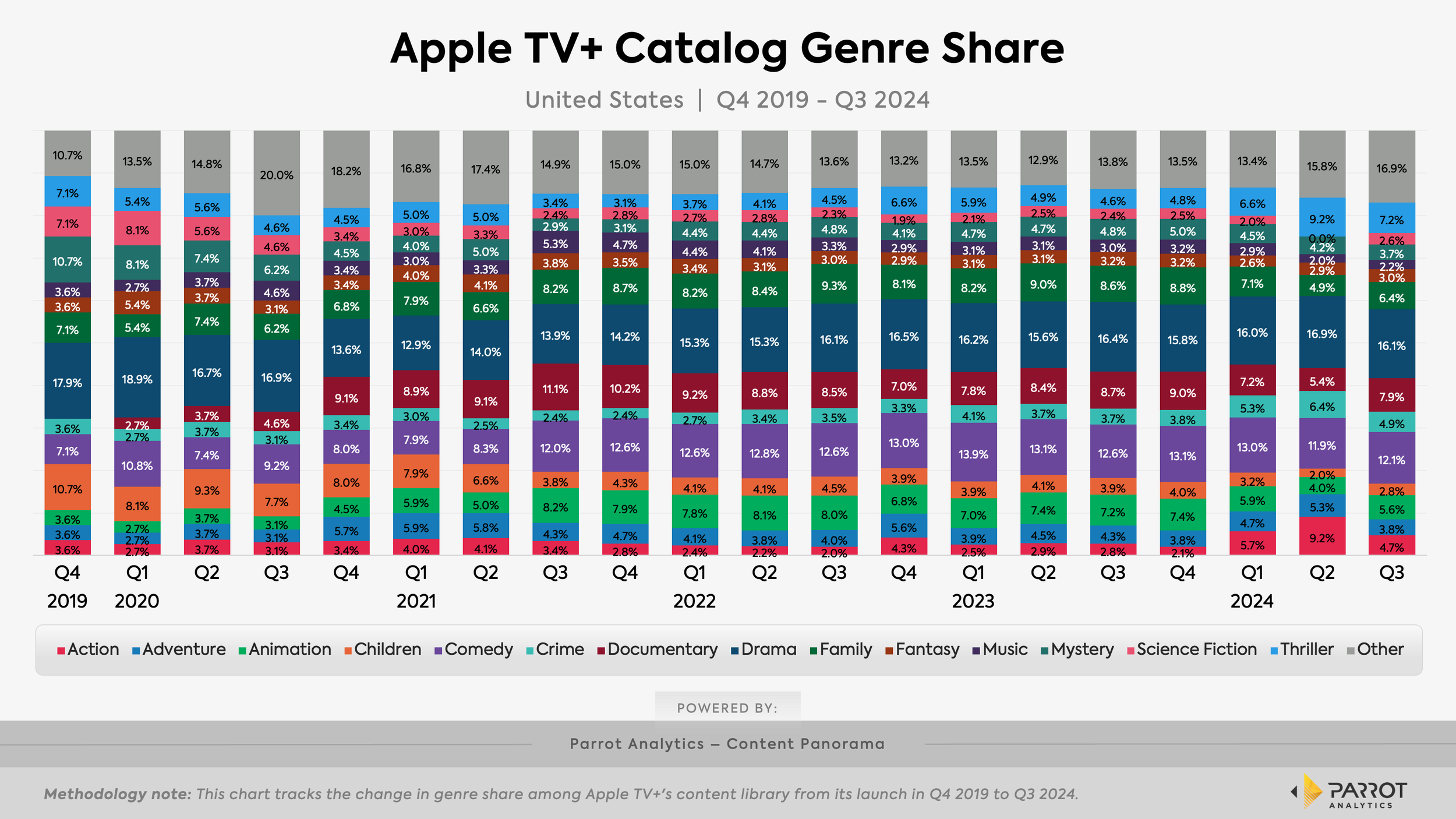

Apple TV+ was likely able to pull this off without a mass exodus of subscribers because it ranks third in original demand share at 8.8%, trailing just Amazon Prime Video (9.4%) and Netflix (36.2%). Curiously, though, Apple TV+’s library hasn’t experienced much change in terms of genre share over the years. Since launching in Q4 2019, it has seen its most notable declines in the sci-fi (-4.5%), Mystery (-6.5%) and children (-7.9%) genres and the most notable increases in comedy (+5%) and documentary(+5.2%) genres, per Parrot Analytics. For better and for worse, the streamer’s library has remained relatively static in terms of genre share.

War drama Masters of the Air emerged as one of Apple’s most successful originals earlier this year while the murder mystery legal drama Presumed Innocent’s made waves in Q3. Limited family drama series Disclaimer, crime dramedy Bad Monkey Season 1, dramedy Shrinking S2 and sci-fi drama Silo S2 are all Q4 2024 arrivals with mystery thriller Severance S2 coming in January. All these shows, along with beloved comedy Ted Lasso, rank among the most in-demand series available on the streamer thus far through Q4.

But with a US library that is nearly 4,000% smaller than Netflix’s, Apple TV+ must consider whether or not a greater variety of genres is needed to create a more commercial offering. There’s no debate that Apple’s star-studded premium originals have garnered acclaim and affection from its loyal audience while adhering to the company’s splashy brand image. But if we’re focusing solely on streaming success, licensing larger blocks of external programming in order to extend user engagement has been a consistent talking point surrounding Apple TV+, which is estimated to have a smaller subscriber base than its competitors. The longer a subscriber spends within a given digital ecosystem, the better churn rate that platform generates which improves the lifetime value of that customer. More broad appeal is needed to ignite greater growth, which may require altering content investments and rejiggering the genre share equation.