Originals vs Licensed Content: Why Streamers All Have Their Own Magic Numbers

Splashy originals drive new subscription growth, engaging library titles are key for retention and certain movies and TV series are extremely valuable on the licensing market, which Hollywood is opening up yet again after years of in-house consolidation. As Wall Street prioritizes revenue over raw growth and every major media company is attempting to claw its way towards streaming profitability, all three elements have taken on new importance. Identifying the composition of each major streamer’s top performers with this in mind can help provide a snapshot of strengths and whitespace opportunity.

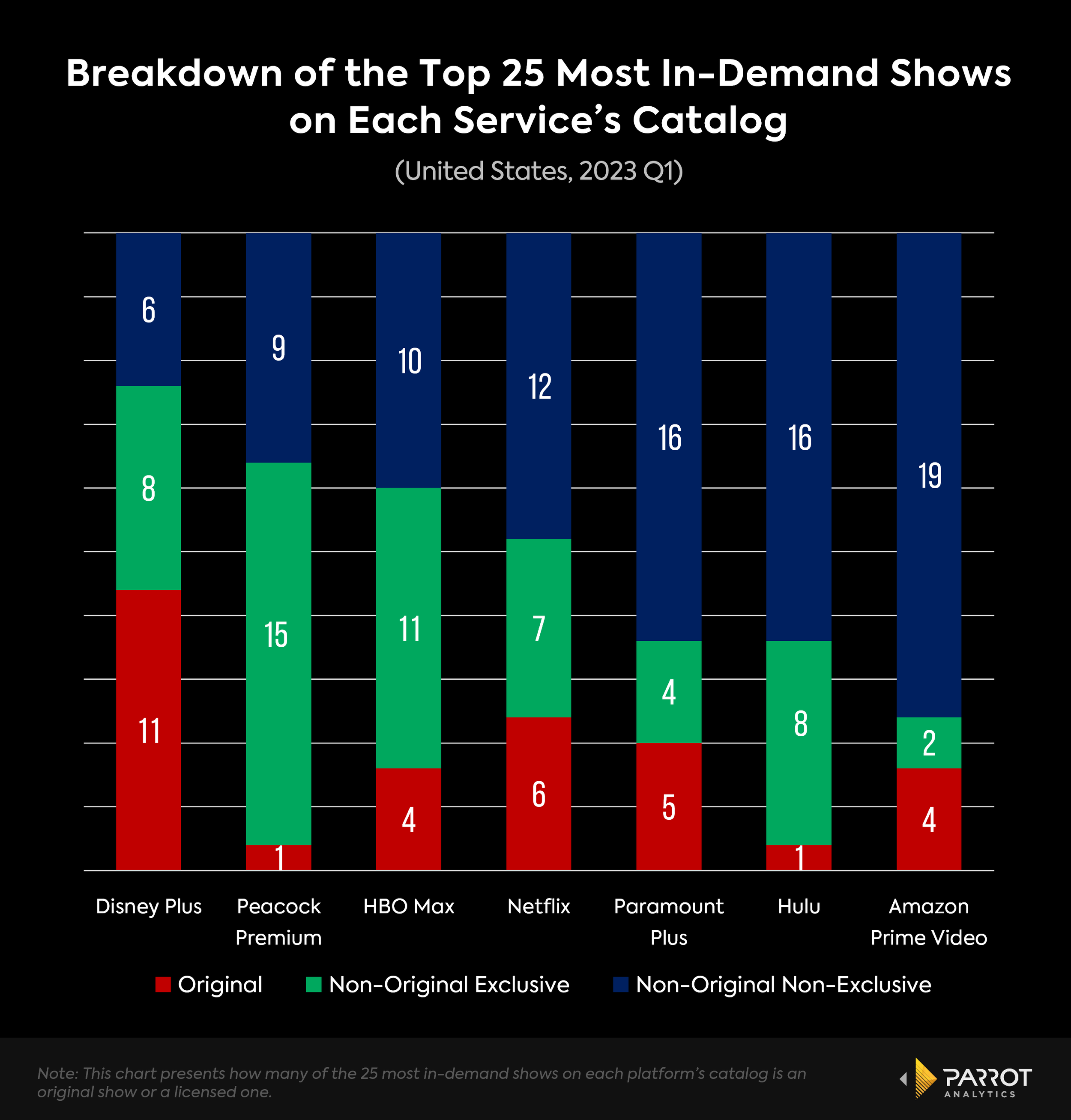

When we look at the 25 most in-demand series for Disney+, Peacock, HBO Max, Netflix, Paramount+, Hulu and Amazon Prime Video in Q1 2023 (Jan. 1-March 31), according to Parrot Analytics, we see a few key trends emerge.

Disney+ leads the pack with 11 platform originals among its top 25 last quarter. Thanks to its regular cadence of franchise-supported Marvel and Star Wars TV series, Disney+ is the fastest-growing streamer in global demand for streaming originals since launch as it has increased its audience share from 3.6% in 2020 to 9.4% as of Q1 ’23.

Netflix is second with six platform originals among its top 25. However, this underscores the precarious position the market-leading streamer is in. Licensing partners may eventually want to reclaim non-original hits such as The Flash and The Walking Dead or license the titles to a higher bidder. This positions Netflix to either pay increased licensing fees or keep shelling out big bucks for new originals at a time when the company wants to stabilize its content budget.

A service such as Peacock thrives on NBCUniversal titles that are owned in-house and could theoretically be licensed externally for impressive sums.

The key takeaway? Each major streamer is built differently and each is attempting to survive the streaming wars with strategies that play to their strengths.