Image 1 of 3

Image 1 of 3

Image 2 of 3

Image 2 of 3

Image 3 of 3

Image 3 of 3

Add To Cart. Innovid's CPG Guide To CTV

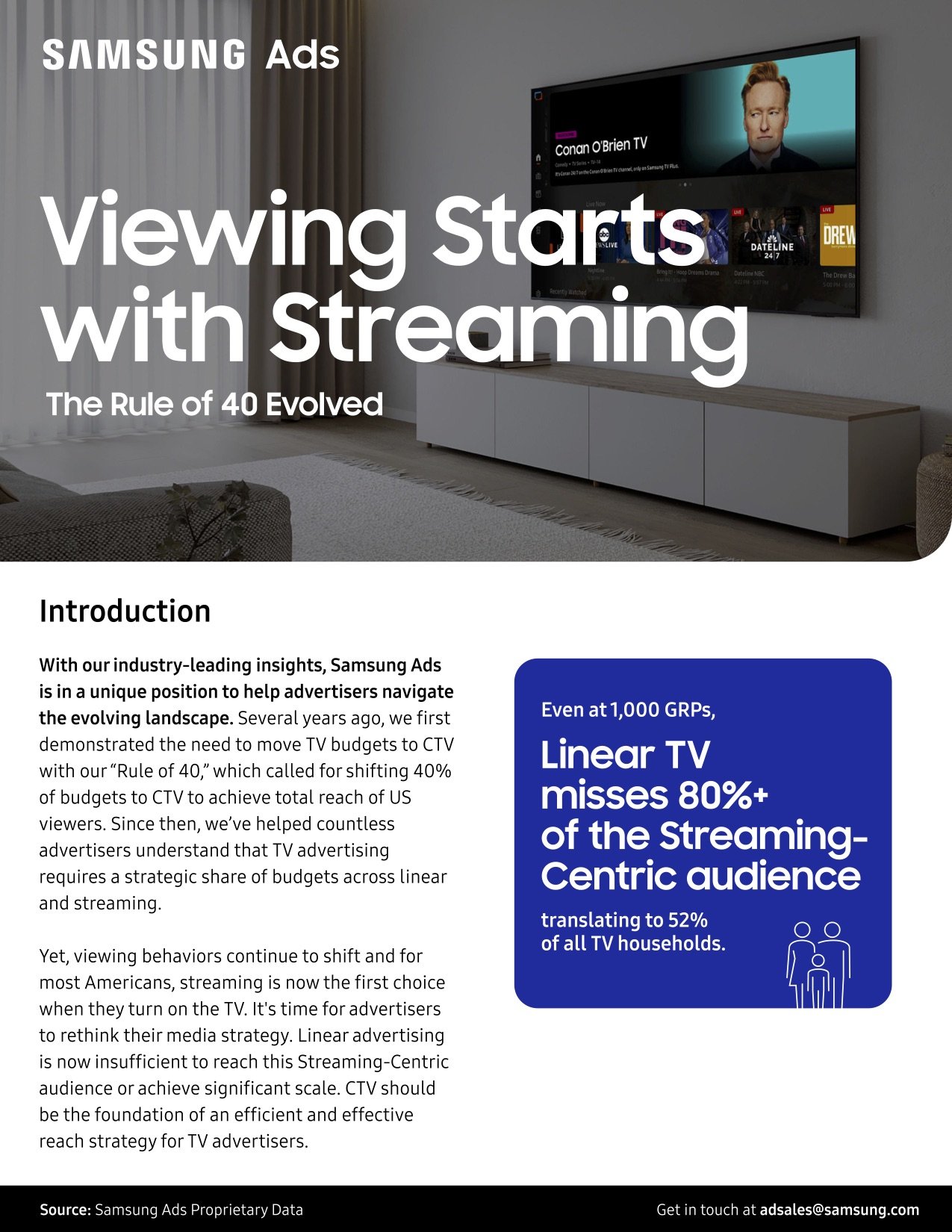

Consumer behavior is changing at an unprecedented speed. And this velocity creates new challenges for CPG brands. Notably, brand loyalty is shifting, reach is disaggregated across channels, consumers are preferring ecommerce shopping, and their return on investment (ROI) is growing increasingly difficult to quantify.

Why? For one, 2021 brought supply chain disruptions and subsequent inventory shortages across the board. Another important factor is fragmented channels and platforms. Each of these bring unique measurement, creative specifications, and other requirements. Meaning, it can be timely and costly to achieve the level of visibility needed for success. Plus, it makes it all the more challenging to extract actionable insights across channels and platforms.

Lastly, the rise in ecommerce has compelled CPG brands to rethink their digital advertising strategy. Consumers now expect a frictionless path to purchase, even from ads.

To alleviate these pressures, many CPG brands turned to connected television (CTV) in 2021 for its ability to reach consumers with personalized, cutting-edge advertising formats in a largely unsaturated space. In fact, despite trials and tribulations, CPG brands overall increased their presence on CTV and saw boosts in engagement compared to other channels.

For these reasons, innovid’s watchword for CPG is venture. As CPG brands dive deeper into the CTV landscape, they can also begin venturing into its plethora of performance-driven strategies like dynamic creative optimization (DCO) and creative formats like shoppable, interactive, and QR codes. Likewise, they’re also beginning to explore more unified measurement solutions that play well with CTV.

Innovid predicts that CPG brands will continue increasing their presence on CTV, as they are empowered with these experiences, tools, and benchmarks that can reinforce brand loyalty and attract new customers–all from the comfort of their couch.

Consumer behavior is changing at an unprecedented speed. And this velocity creates new challenges for CPG brands. Notably, brand loyalty is shifting, reach is disaggregated across channels, consumers are preferring ecommerce shopping, and their return on investment (ROI) is growing increasingly difficult to quantify.

Why? For one, 2021 brought supply chain disruptions and subsequent inventory shortages across the board. Another important factor is fragmented channels and platforms. Each of these bring unique measurement, creative specifications, and other requirements. Meaning, it can be timely and costly to achieve the level of visibility needed for success. Plus, it makes it all the more challenging to extract actionable insights across channels and platforms.

Lastly, the rise in ecommerce has compelled CPG brands to rethink their digital advertising strategy. Consumers now expect a frictionless path to purchase, even from ads.

To alleviate these pressures, many CPG brands turned to connected television (CTV) in 2021 for its ability to reach consumers with personalized, cutting-edge advertising formats in a largely unsaturated space. In fact, despite trials and tribulations, CPG brands overall increased their presence on CTV and saw boosts in engagement compared to other channels.

For these reasons, innovid’s watchword for CPG is venture. As CPG brands dive deeper into the CTV landscape, they can also begin venturing into its plethora of performance-driven strategies like dynamic creative optimization (DCO) and creative formats like shoppable, interactive, and QR codes. Likewise, they’re also beginning to explore more unified measurement solutions that play well with CTV.

Innovid predicts that CPG brands will continue increasing their presence on CTV, as they are empowered with these experiences, tools, and benchmarks that can reinforce brand loyalty and attract new customers–all from the comfort of their couch.

Consumer behavior is changing at an unprecedented speed. And this velocity creates new challenges for CPG brands. Notably, brand loyalty is shifting, reach is disaggregated across channels, consumers are preferring ecommerce shopping, and their return on investment (ROI) is growing increasingly difficult to quantify.

Why? For one, 2021 brought supply chain disruptions and subsequent inventory shortages across the board. Another important factor is fragmented channels and platforms. Each of these bring unique measurement, creative specifications, and other requirements. Meaning, it can be timely and costly to achieve the level of visibility needed for success. Plus, it makes it all the more challenging to extract actionable insights across channels and platforms.

Lastly, the rise in ecommerce has compelled CPG brands to rethink their digital advertising strategy. Consumers now expect a frictionless path to purchase, even from ads.

To alleviate these pressures, many CPG brands turned to connected television (CTV) in 2021 for its ability to reach consumers with personalized, cutting-edge advertising formats in a largely unsaturated space. In fact, despite trials and tribulations, CPG brands overall increased their presence on CTV and saw boosts in engagement compared to other channels.

For these reasons, innovid’s watchword for CPG is venture. As CPG brands dive deeper into the CTV landscape, they can also begin venturing into its plethora of performance-driven strategies like dynamic creative optimization (DCO) and creative formats like shoppable, interactive, and QR codes. Likewise, they’re also beginning to explore more unified measurement solutions that play well with CTV.

Innovid predicts that CPG brands will continue increasing their presence on CTV, as they are empowered with these experiences, tools, and benchmarks that can reinforce brand loyalty and attract new customers–all from the comfort of their couch.