The Year Ahead: Our Fearless Predictions For 2022

2022 is here and time for another round of TVREV's Fearless Predictions. Given the past two years, we will admit it’s hard to know what to expect in the coming year, but assuming that things return to a degree of normalcy at some point, here’s our top ten predictions for the new year:

1. Nielsen Finally Gets The Boot (Sort Of)

Every year advertising and network executives promise that this is the year they are finally going to get rid of Nielsen. And yet, like Lucy with the football, every year they decide it’s too soon.

Nielsen is admittedly a tough habit to break.

That said, there seems to be real traction in the air to, if not get rid of Nielsen, to at least turn to other sources of measurement as well.

TPTB have finally accepted the reality that given that most viewers are watching some combination of streaming and linear and will be for years to come, things really do need to change.

There are already signs that this is happening as the major linear networks, NBCU, ViacomCBS. Disney and WarnerMedia are all looking at (or starting to look at) the possibility of adopting alternate measurement systems based on data from Providers Who Are Not Named Nielsen, companies like (alphabetically) 605, Comscore, Conviva, iSpot, TVSquared and VideoAmp.

The move away from Nielsen, which will also see ads being measured separately from programming and impressions overtaking GRPs, will be gradual. Not so much because it needs to be, but because nothing in the TV industry ever happens quickly.

Something about messing with billions of dollars that just invokes caution it seems.

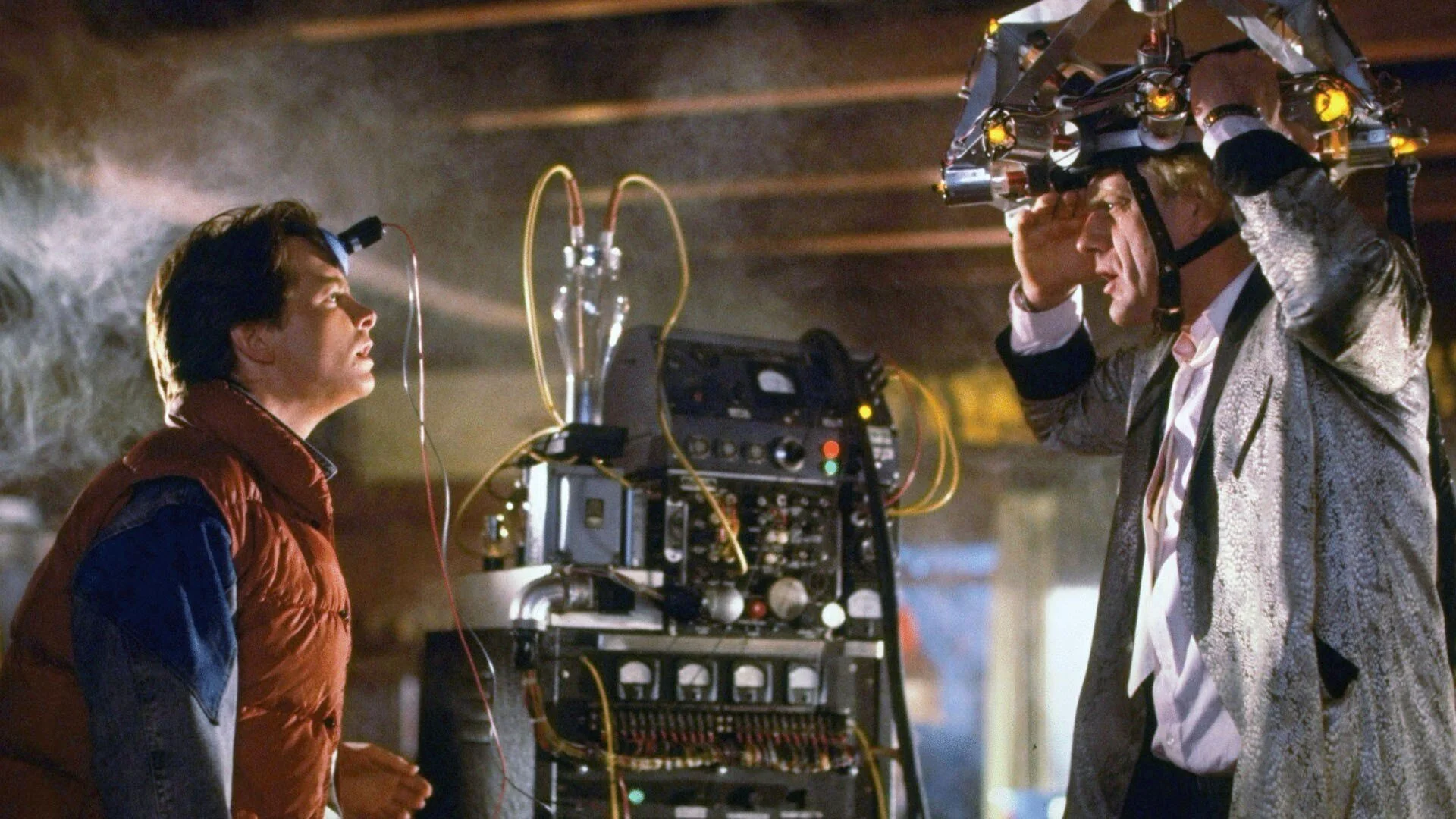

2. Movie Theaters Contract, Movies On Streaming Expand

Years from now, movie theater chains will be part of a Harvard Business School case study, along with taxi fleets, on how businesses who saw their monopoly-like market domination as a green light to ignore their customers were easily disrupted by web-based competitors.

It’s no secret that going to the movies had become a pretty awful experience. Beginning in the 80s, theaters had been chopped up into multiplexes with cramped seating and considerably smaller screens. Theaters often weren’t cleaned between shows, so you had sticky floors and broken seats. Fellow patrons did not use their indoor voices when talking to each other and frequently consulted their smartphones during the movie, lighting up their entire row.

And that was before you got to the snack bar where $20 would buy you a small popcorn and a soda.

Thus it should surprise absolutely no one that people are not jonesing to go back to movie theaters any time soon and that many theaters have permanently shut down during the pandemic.

This is not to say that movie theaters will disappear in 2022 (or ever) but they will be on the downswing, both in terms of actual number of venues and in terms of actual number of moviegoers.

Movies on streaming, however, will see a decent sized upswing, spurred, paradoxically enough, by the overwhelming number of new series on TV.

Follow me here: faced with the choice of devoting 12 hours to a new series or two hours to a new movie, the movie is going to seem like a very appealing option for time-crunched viewers.

And once consumers get settled into that sort of behavior it will be tough for theater chains to woo them back, save the occasional Spiderman flick.

3. Smart TV Operating Systems Become The Most Contested Front In The Streaming Wars

There will be all sorts of fun in the streaming wars this year, a big one being guessing what variety of apps the newly merged Discovery-Warner team will have on offer. (I’m betting on a well-priced combo app along with not-that-well-priced individual options that make the combo app seem like a serious bargain.)

That said, the real action is going to be on the smart TV OS front.

In the U.S. right now, there are three main OEMs: Samsung, LG and VIZIO, as well as Roku, which is not an OEM, but whose operating system is now built into tens of millions of TV sets.

But if you want proof that the TV OS is where the game is at, look at all the big players who are getting in on the smart TV action. Amazon launched their own line of TVs this year, as did Walmart, Comcast and Google. The reason is pretty obvious: the massive improvement of smart TV operating systems means that dongles are dying off, which in turn means that getting your app on As Many Smart TV Operating Systems As Possible is every programmer’s 2022 goal. Not just the Flixes, but all of the dozens of smaller apps who also need to find an audience.

This will put the OEMs in the gatekeeper role traditionally played by MVPDs which also makes all those “take me straight to the app” buttons on their remotes that much more valuable.

The ACR data that they collect, which can be used to better target ads, better promote series and to guard against ad overfrequency will further endear them to ad-supported services, who will be able to offer better viewing experiences as a result. (Look for our upcoming report on Smart TV ACR later this month.)

Outside the U.S., where dongles haven’t really taken hold and where streaming is a bit more nascent, the smart TV operating systems may prove to be an even bigger battleground, as the various services fight for pole position and button position, all while trying to figure out a way to successfully launch their services in a new market.

4. MVPDs Fight Back With Smart TV Leasing

Sky TV in the UK came up with a brilliant idea last year: they would allow their subscribers to lease a smart TV as part of the price of their monthly bundle, which also included their pay TV service.

The new TVs (dubbed “Sky Glass”) would have top of the line features and come with the Sky interface pre-installed, though viewers would still have the option to add their own SVOD apps.

The only catch was that it was a four-year commitment.

American MVPDs went all wide-eyed at this, as it could allow them to get rid of set top boxes, lock customers in for four years, provide a better viewing experience and give them a way to better capture measurement data across linear and streaming using ACR.

So look for at least one American MVPD (probably Comcast, which owns Sky and thus has a head start) to offer something like Sky Glass next year, or to at least start planning to offer something like it.

And then watch at least three or four other MVPDs follow them there.

They’re not wrong. A well priced bundle that gives users broadband, pay TV, some streaming apps and a brand new TV set should prove to be a very, very attractive offer, so my bet is that this will be a successful development, one that will help to impact our next prediction.

5. Cord Cutting Slows Down Ever So Slightly

Cord cutting—giving up any sort of linear pay TV altogether (e.g., no vMVPDs) is going to continue to happen in 2022, albeit at a slightly slower pace than in 2021. That’s partly because Omicron means we’re going to be at home again more than we thought we would and partly because the array of streaming services out there still seems way too confusing for a significant part of the population who may watch Netflix now and again, but likes the comfort of knowing they can still pick up the remote and click through all 852 channels any time they like.

Which is not to say that pay TV subscriptions are going to rise—pay TV providers will continue to shed somewhere around 5% to 7% of their subscriber bases next year—but rather, that the percentage of cord cutters is unlikely to go much higher.

So no “massive wave” of cord cutting anytime soon, a significant stat in light of the fact that there is likely a floor on cord cutting too: somewhere between 30% to 40% of viewers are only going to give up their set top box-based pay TV when someone physically pries the remote from their cold dead hands.

Meaning the industry is going to have to deal with a mixed viewing environment (linear and streaming) for many years to come.

6. VMPDs Continue To Grow

Many people consider switching to a vMVPD to be a form of cord cutting though in reality all they are doing is swapping one form of delivery (cable) for another (broadband.)

Still, there are considerable savings involved in switching to vMVPDs which are generally less expensive than traditional pay TV and don’t include the often punitive fees MVPDs charge to “rent” their set top boxes.

The switch also allows viewers to make use of a single interface—their smart TV OS —for all their viewing. This alone—the ability to stop switching inputs from set top box to streaming—should be enough to get many people to switch.

There are bundling deals too—a Hulu Live TV subscription now comes with Disney+ and ESPN+— and that will also help boost their appeal.

For many viewers, vMVPDs are a nicotine patch of sorts, a way to get rid of the physical trappings of traditional pay TV without giving up the ability to actually watch all their favorite cable channels, plus local news and sports.

Thus we can expect another big growth year for the main vMVPDs—Hulu (which will benefit from the aforementioned bundle), YouTube, Sling, DirecTV and Fubo.

7. Addressable TV Advertising Booms, Spurred By Election Ads

Addressable advertising on streaming (CTV) is a given, but it’s taken a while to take root in linear. That’s not for a lack of trying, it’s just that advertisers remain convinced that TV is for mass reach while digital (mobile and display) is for targeting.

That’s slowly changing however, as more advertisers spend more money on CTV and realize that they are not really sacrificing anything by targeting.

Similarly, the use of data on TV is maturing and privacy is (slowly but surely) being figured out. Ditto measurement.

Meaning that rather than just using streaming to get incremental reach for their linear buys, advertisers are going to start looking at how much of their demo their ads are reaching and using those stats to double down on reaching that audience on linear via addressable buys.

Spurring it all on will be the massive influx of money that is going to be spent on the midterm elections this fall. Since that spending is mostly going to need to be (a) local and (b) targeted, we should see a significant uptick in the amount of money being spent on linear addressable.

So this should finally be the year that linear addressable breaks through and cross-platform buying becomes the norm. Though given how slowly the industry changes, we’re unlikely to see the real impact of these changes until 2023 od 2024.

8. FASTs See Rapid Growth, Especially Overseas

FASTs are both free and serve to fill the role traditionally played by dozens of cable networks: they provide a wide array of lean back “comfort food TV” for those times you don’t feel like leaning in.

Most provide a combination of linear-like channels and VOD options and some of the bigger ones are even moving into original content.

All good reasons for why the FASTs will continue to expand in the U.S.

In 2022 however, their real growth opportunity is in emerging economies overseas where the majority of the population does not have the sort of income that would allow them to pay U.S. style prices for SVOD. (See Netflix’s struggles in India.)

If the various U.S. networks (VCBS, FOX and NBCU in particular) are smart, they will launch in these regions with their FASTs first, while providing upgrade opportunities and/or one-time movie rental opportunities.

It’s the best way to break into markets where even $5/month is a small fortune for TV programming.

9. Churn Continues To Mess With The Flixes, Paramount And Peacock In Particular

As I’ve no doubt mentioned a good dozen times before, most of the Flixes have yet to establish a solid identity.

With the exception of DIsney+ and Discovery+ they all tend to highlight their own “HBO-like” programming (e.g., prestige dramas and dark comedies aimed at affluent, educated voters in the Coastal States.)

The problem is that given most have month-to-month contracts, viewers get into the habit of subscribe-binge-unsubscribe, a process that can only be delayed slightly by way of weekly releases.

Netflix is largely immune from this, as they are the OG service and the one people are least likely to give up. Amazon sells free two-day delivery not television, which is just a lucky strike extra, so they’re immune too. Apple TV+ seems to be more of a marketing tool than an actual service. Disney/Hulu and Discovery/HBO Max have the power of bundles, which gives them some degree of immunity too.

Which leaves Paramount+ and Peacock out there as 2022’s Services Most Likely To Be Churned.

10. What Happens With Sinclair’s Planned RSN Apps Will Be Key To The Future Of Televised Sports

Sinclair’s CEO Chris Ripley is claiming that he does have the rights to show MLB games on the RSN streaming apps he plans to launch this year. MLB Commissioner Rob Manfred has unequivocably said he does not.

Not having insider privileges at either organization, I’m not going to hazard a guess as to who is telling the truth.

Rather, I’d tell you to watch what happens there closely.

If Sinclair prevails, it means that the RSN system, which gives third parties the right to pay vast sums of money in order to broadcast MLB, NBA and NHL games will remain in place and that it will just shift online.

Given that there are likely millions of people who continue to subscribe to pay TV in order to see their favorite teams play, this shift will be significant.

If the MLB prevails, it means it does not and rights will revert to the league and/or the teams, and the thing to watch out for is what they do next.

Do they launch their own apps and effectively capture the streaming audience that way? Do they do a single league app or do they launch individual team apps? (The latter could, of course, be an option on the former.)

Or do they ignore streaming altogether and assume their audience will keep watching them on linear?

That’s a good move financially in the short term (lots of money in those RSN deals) but a bad one in the long term, as all of the Big Four sports leagues need to attract younger viewers and streaming is the only way they can do so.

One of the many things we need to keep an eye on as 2022 unfolds.

Happy New Year to all and don’t forget to subscribe to all our TVREV newsletters.

BONUS PREDICTION: The Media Elite Continues To Ignore Linear TV Even Though Consumers Don’t

This is admittedly a pretty easy prediction. The media has long ignored popular shows if they seem a little, you know, downscale. If you recall, Mad Men, the much buzzed about AMC hit of the 2000s, often did not break 1M viewers per episode, but punched well above its weight in terms of press coverage, while Home Improvement and Roseanne, whose sizable audiences did not include many people who worked in the media, were seriously underreported back in the 90s when the media gaze was on Friends and Seinfeld.

The awards shows will also ignore most network series, rewarding the streaming fare that garnered the most buzz. (There’s a whole other bit in there about Academy members not actually seeing the shows they’re voting on, given the vast number of them, and voting instead for the ones that got the most press coverage. But that, friends, is an article in and of itself.)

Meanwhile, tens of millions of people will continue to watch network prime time, reality TV in particular. That “massive wave” of cord-cutting will still fail to materialize. And advertisers, particularly those selling mass-market products, will continue to spend a whole lot of money on linear TV because that’s where their consumers are.

This will in turn confuse and infuriate (yet again) a great many people who expected TV to shape-shift as quickly and seamlessly as the newspaper and movie industries did and, maybe, just maybe, result in a more widespread realization that this period of mixed (streaming and linear) viewing is not going away any time soon and so we need to rethink the way we measure it. (See Prediction #1)