CTV Might Get The Headlines, But Social Video Is Still a Juggernaut

Video content has risen to the forefront of social media, rendering "social video" almost synonymous with modern social media itself. A June 2023 eMarketer report showed that 58.8% of social media time is spent on video, up from 33% in 2019. The rapid rise of video-first platforms like TikTok has undoubtedly contributed to the trend. Following TikTok’s lead, Instagram's Reels and Snapchat's Stories have become central to their platforms' user experiences, demonstrating the industry-wide pivot to video-centric content strategies.

As brands navigate the omnichannel landscape, social video remains a focal point of the media mix, commanding an increasing share of attention and investments in 2024. Fresh data from Mediaocean's 2024 Outlook Report confirms as much.

Let’s unpack the insights.

The Persistent Appeal of Social Video

Two years ago, social video was heralded as the consumer trend to watch, and that proved prescient. In 2023, an impressive 69% of survey respondents indicated plans to increase their investment in social video for 2024, marking the highest intention rate since the original survey.

While Connected TV (CTV) has emerged as a critical channel, garnering considerable attention as it revolutionizes how viewers consume television content, it has not seen the same unequivocal enthusiasm from advertisers. Only 56% of respondents expressed intentions to boost their CTV spend in 2024. Despite CTV's allure, its ecosystem—characterized by nascent AVOD (Advertising-based Video on Demand) products and the ongoing development of targeting and measurement capabilities—pales in comparison to the mature, efficient engine that drives social video advertising.

The juxtaposition of social video and CTV spending trends underscores a broader strategic imperative: the necessity of an omnichannel approach. Today's consumers interact with brands across a multitude of channels, making it critical for advertisers to not only understand but also skillfully navigate this complexity. However, achieving optimal reach and frequency across CTV and digital channels continues to challenge marketers, with 36% of respondents citing it as a significant issue.

The Creative Imperative in Omnichannel Success

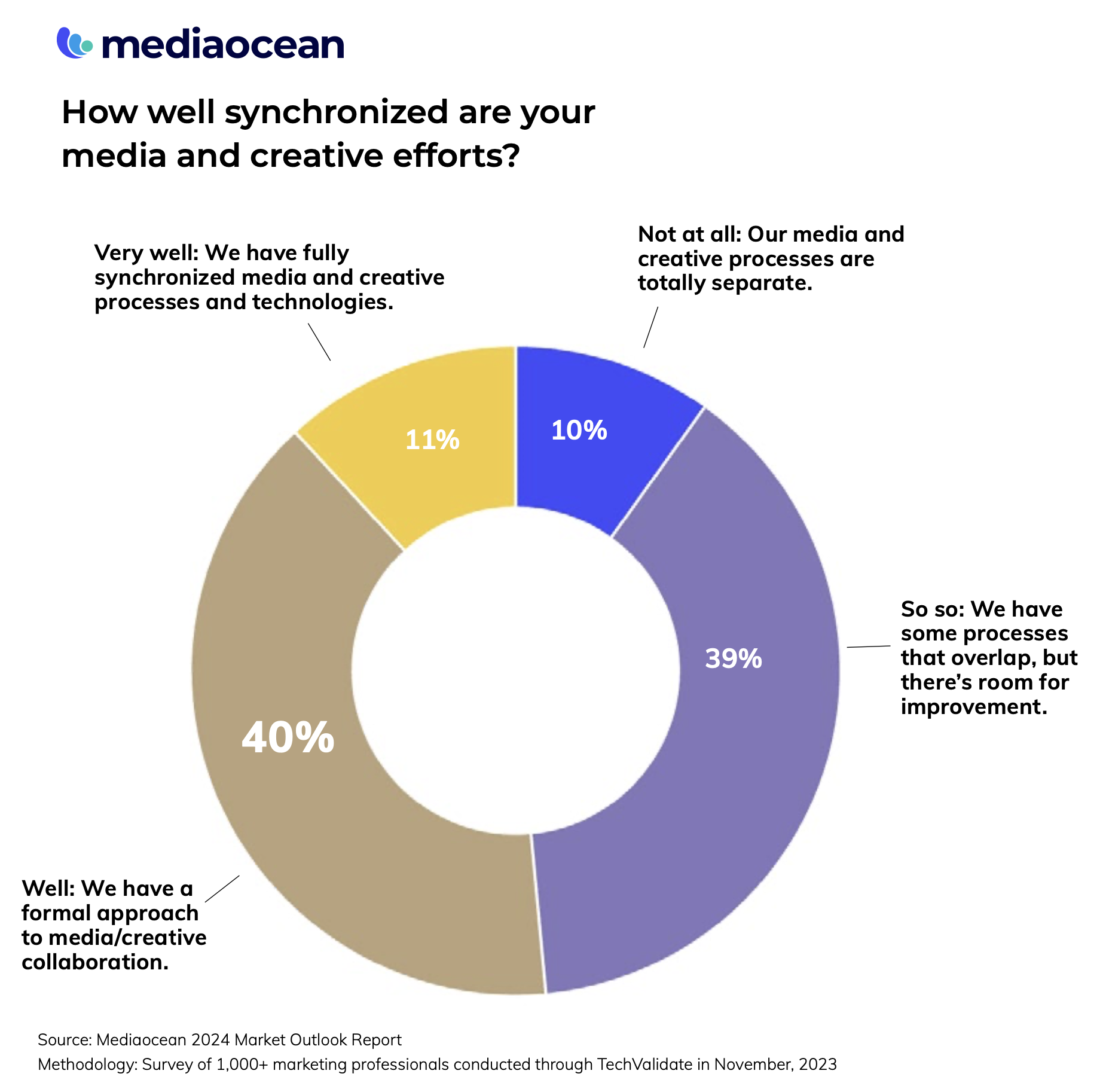

At the heart of the omnichannel challenge lies the "creative-media gap" — a disconnect between media planning and creative execution that hampers campaign effectiveness. A staggering 89% of respondents acknowledged the absence of fully synchronized media and creative processes, echoing concerns about operational inefficiencies and the dilution of messaging relevance. This gap not only escalates costs and prolongs go-to-market timelines but also diminishes consumer engagement, highlighting an urgent need for integrated ad tech solutions that enhance creative relevance and activation across channels.

Addressing the creative-media gap emerges as a paramount opportunity for brands aiming to capitalize on the dynamic digital advertising landscape. By fostering collaboration between siloed teams and leveraging technology that supports a unified, omnichannel workflow, advertisers can significantly enhance the relevance and impact of their messaging. In a year poised to be shaped by challenges such as data deprecation and privacy regulations, closing this gap offers a pathway to not only improved operational efficiency and market responsiveness but also substantial growth and competitive advantage.

With an omnichannel approach to creative personalization and media placement, advertisers can worry less about which channel is catching headlines and rest assured that their message will be seen consistently across every touchpoint with the brand whether it’s via CTV, social, or any other platform.