Reported New Media Rights Deal Cements NBA As TV’s No. 2 Property

Since Disney and Warner Bros. Discovery’s exclusive window ended, the NBA’s media rights negotiations have been a bit of an open secret. And now, those deals are nearly complete, as this week’s reporting from the Wall Street Journal indicate.

The NBA is expected to agree to a new, 11-year media rights deal worth about $76 billion total — or $6.9 billion per year combined from existing partner Disney and new partners NBCUniversal and Amazon Prime Video. That’s a about a 2.6x increase from its previous deal with Disney and Warner Bros. Discovery.

Though the NBA’s long been a popular TV product, nearing $7 billion per year in national TV revenues does put it into a brand new stratosphere when the contract starts for the 2025-26 season. Utilizing all publicly available figures, the chart below shows just how much distance the NBA has put between itself and other U.S. sports properties aside from the NFL.

We can acknowledge the behemoth the NFL is here without taking away from the NBA’s successful navigation of media rights negotiations here. The league’s current deal has it sitting just $500 million or so above MLB’s media rights payouts. The new one more than triples MLB’s (and MLB, which relies more heavily on local TV rights, is dealing with its own issues on that front as well).

More impressive still is that the NBA managed to both strengthen its foothold in linear TV by trading cable (TNT) for broadcast (NBC), while also pushing even further into streaming between Amazon Prime Video, Peacock and ESPN’s forthcoming direct-to-consumer app.

That eye toward the future, in particular, creates a fascinating dynamic for the sport, and televised sports overall. While NFL, MLB and NHL games have had national games streaming in one way or another for years, the NBA’s streaming outpost has largely been local-market games through its League Pass service.

Now, the NBA is arguably the first of the four major U.S. leagues with a major part of its weekly schedule — and major playoff series — housed on a streaming service. Yes, the NFL has Thursday Nights on Prime Video and Sunday Ticket on YouTube TV, but you don’t need streaming to watch games every Sunday if you just keep to your locally-windowed contests (though that dynamic may be changing too with better contests on Prime this season and the Netflix Christmas games).

The assumed structure of the NBA’s schedule with three partners will make streaming unavoidable, in the best way for the league and its partners as they transition pro basketball into a full-week national TV product growing directly out of the behaviors already observed in its young and very online community of obsessives already.

On linear TV, iSpot data showed last year that the NBA was already the No. 4 programming choice by household ad impressions in 2023, and it was No. 2 in primetime, only trailing the NFL. One would think the new deal sees those totals grow with NBC in the fold, even if some viewership winds up more streaming-focused going forward as well.

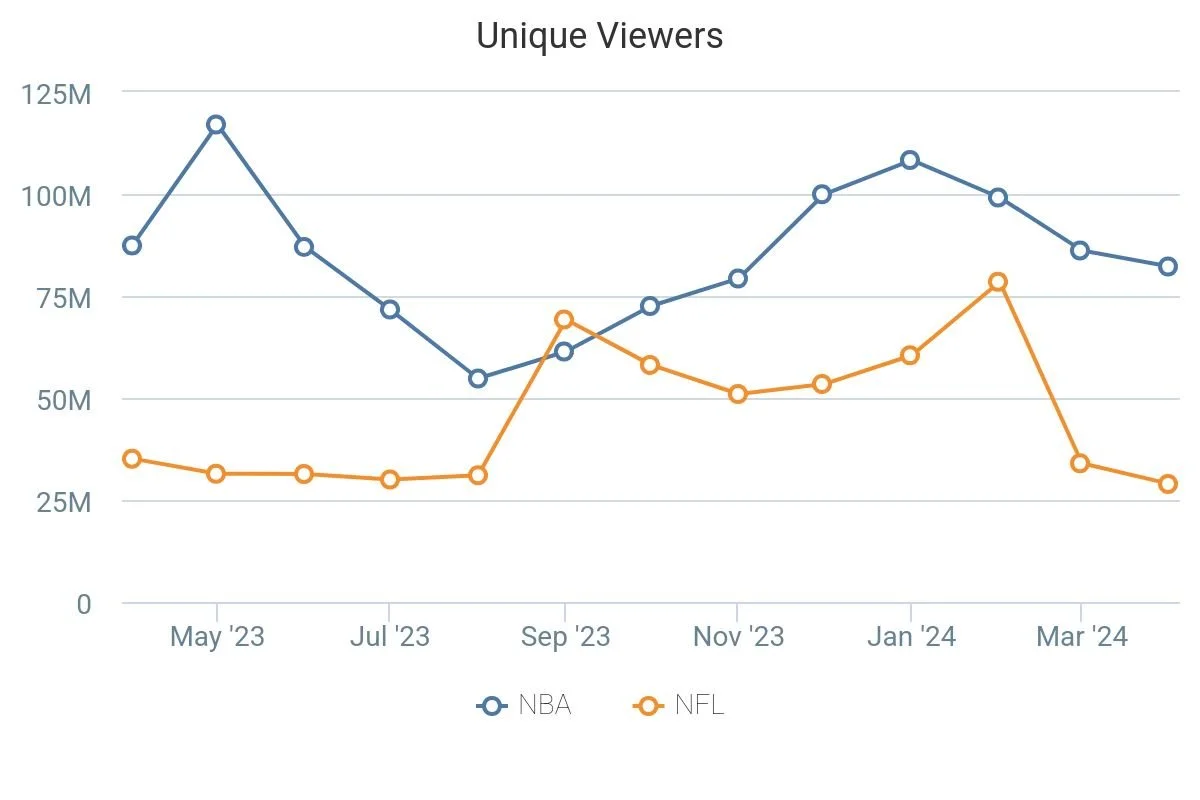

To that point, the streaming focus should play directly into existing behaviors. Tubular Labs data already shows that globally, the NBA’s already outpacing the NFL’s audience reach across Facebook and YouTube video more often than not. Converting those viewers into streaming audiences on Prime Video/Peacock/ESPN DTC is a task, but one the NBA already seemingly understands. The league’s averaged 85.2 million unique viewers across the two platforms dating back to last April.

After years of talking about its growth as an entertainment product, the NBA’s now cashing in on what it’s built. The result should mean monumental changes for the game (and hey, maybe a return for the Seattle Supersonics in the near future?). But also the way we’re watching sports. As other leagues watch intently, the NBA’s approach here should shed light on how the next round of major media rights negotiations take shape at the end of this decade.